SERVICES

The difference between who you are & who you want to be.

Audit & Assurance

Audits assure the stake holders and management that their accounts are reliable and internal controls framed are operating efficiently. All corporate entities incorporated in India and specified non-corporate entities are required to be audited under various statues.

We have been engaged as Auditor under various statutes by various entities like corporate, banks and non-corporate entities.

- Statutory Audits [Companies Act, 2013]

- Tax Audits [Income Tax Act, 1961]

- Audit Bureau of Circulation Audit

- RNI Audit

- Audit of Not-for-Profit Organizations

- Statutory Audits [Companies Act, 2013

and LLP Act ,2009] - Tax Audits [Income Tax Act, 1961]

- Audit Bureau of Circulation Audit

- RNI Audit

- Audit of Not-for-Profit Organizations

- Internal Audit

Direct Taxation Laws

With increasing complexities in Direct Taxation Laws , our tax team assures that that taxation of the enterprises are in compliance with tax laws along with Fulfilling representation & advisory roles with respect to the legal framework & regulatory compliance of direct taxation laws in India.

- Income Tax

- Goods & Service Tax Laws

- Structuring – Outbound & Inbound

- Issuance of Form 15CA/CB

- Tax Return filing for expatriates & Non-resident Indians

- Preparation of Income Tax Returns/TDS Returns

- Appearing before Assessing Officers and Appellate Commissioners

- Appearing before Income Tax Appellate Tribunal

- Providing consultancy relating tax planning and optimisation

- Providing consultancy related to Business Restructuring, Tax aspects of Mergers and Acquisitions, Joint Ventures etc.

- Providing consultancy relating to International Taxation

- Structuring – Outbound & Inbound

- Issuance of Form 15CA/CB

- Tax Return filing for expatriates & Non-residents

Indirect Taxation

Our indirect team assures the compliances of indirect taxation includes Goods & Service Tax, Service Tax, Value Added Tax with which covers all the three ambit of tax laws i.e. Compliance, Advisory and Litigation.

Our Indirect taxation services include:

- Preparation of VAT / Service Tax / Excise / GST Returns

- Appearing before Assessing Officers & Appellate Commissioners

- Appearing before Appellate Tribunals

- Providing consultancy relating tax planning and optimisation

- Internal Audit

- Management Audit

- Forensic Audit

- Stock Audit

- Investigation Audit

- Process

- Performance Management

- Financial Stress Test

- System Audit

- Concurrent Audit

- Mystery Audit

- Management

Cross Border Transactions

Transfer Pricing:

Transfer pricing regulations are a mine field of litigation that remain under the watchful eye of Taxation authorities. Our transfer pricing team provides a considerable number of services regarding your global assignments & consequent transactions.

Our services include:

- Transfer Pricing Study

- Comparability Analysis

- Litigation

- Formulating Agreements

- Devising Billing/Benchmarking

- Methodologies

- Transfer Pricing Advisory

FEMA:

The Foreign Exchange Management Act, 1999, is an Act which consolidate and amend the law relating to foreign exchange with the objective of facilitating external trade and payments and for promoting the orderly development and maintenance of foreign exchange market in India. Our FEMA teams provide one window solution for end-to-end FEMA consultancy and compliance services in India

Our services include: Structuring of

- Filing of Forms at RBI portal

- FEMA audit

- Compounding of offences

- Inbound and Outbound Investments

- Advisory

- Misc. services

Transaction Advisory

In the post-liberalisation economic era, Indian & global companies operating in India have witnessed phenomenal growth. This rapidly evolving, competitive landscape demands timely transaction advisory. We aim to meet your dynamic needs to our best capabilities.

- Due Diligence –

- Financial, Operational,

- Legal & Secretarial

- Valuation & Business

- Modeling

- Mergers, Demergers &

- Acquisitions

- Restructuring &

- Turnaround Managements

- Business Plan Analysis

- Due Diligence – Financial, Operational, Legal & Secretarial

- Valuation & Business Modeling

- Mergers, Demergers & Acquisitions

- Restructuring & Turnaround Managements

- Business Plan Analysis

Other Advisory

- Allied Laws Advisory

- Consultancy to Family-owned Businesses

- Growth Consultancy

- Succession & Estate Planning

- Company Law

- IFRS Advisory

- Foreign Exchange

- Management Act (FEMA) –

Regulatory & Advisory

- Consultancy to Family-owned

Businesses - Growth Consultancy

- Succession & Estate Planning

- Risk Advisory

- Company Law Advisory

- IFRS Advisory

- Allied Laws Advisory

Interested in our services?

Blogs

Slow non-moving stock

Hiii, meet Mr. Jugadu- Owns Manufacturing company.His company was making good profits, but still he felt that there was shortage of cash, that forced him

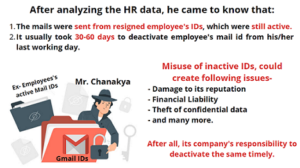

Potential misuse of inactive email IDs

Say hii to Mr. Smoothie, who manages all his business sectors very smoothly. Everything was going fine, but from last 6 months they received complaints

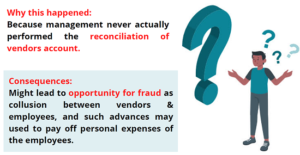

Review of advances to vendors

Let me introduce you to Prem, who was facing some problem in his business. So, he hired Mr. Chanakya to find out why he had