Our Story

Strong in will, to strive, to seek, to find, and not to yield.

ABOUT US

Established in 1981, Jain Shrimal & Co. (JSCO) is a power player in the practices of Statutory Audit, Income tax, GST Laws, Financial Due Diligence, International Taxation, Transfer Pricing & FEMA. Additionally, we assist you with our emerging innovations in Risk advisory, Forensic & Fraud Audit and Management consulting.

Our Focus

Our focus is to provide clients with a ‘One-Stop Solution’ for all their business, financial and regulatory requirements. We mainly focus on ‘Experience, Expertise and Efficiency’ .

Our Dream

Our Core Values

Accountability

Leading with quality client experience

Wisdom

Striving to provide knowledge-oriented insight

Creativity

An inclusive environment for everyone to explore creatively

Community

A spirit of collaboration within internal & external stakeholders

Passion

An ardent advocate of joyful, impassioned people

Our Services

Audit & Assurance

Our Audits team assure the stake holders and management that their accounts are true and fair and internal controls framed are operating efficiently.

Direct Taxation Laws

Our direct tax team helps for compliance of Income Tax Act which covers all the three ambit of tax laws i.e. Compliance, Advisory and Litigation.

Cross Border Transaction

With increasing globalization, our cross border transaction team assures that International transactions between the companies are in compliance with tax & regulatory laws.

Indirect Taxation

Our indirect team assures the compliances of indirect taxation includes Goods & Service Tax, Service Tax, Value Added Tax with which covers all the three ambit of tax laws i.e. Compliance, Advisory and Litigation.

Transaction Advisory

Our team helps you to identify risks in transactions, so you can make informed strategic decisions with confidence. It has an experienced team having deep industry and local market knowledge, as well as technical experience tailored to suit each client’s situation.

Other Advisory

Apart from different service verticals, our team also provide advices which respect to miscellaneous business requirements.

Our Partners

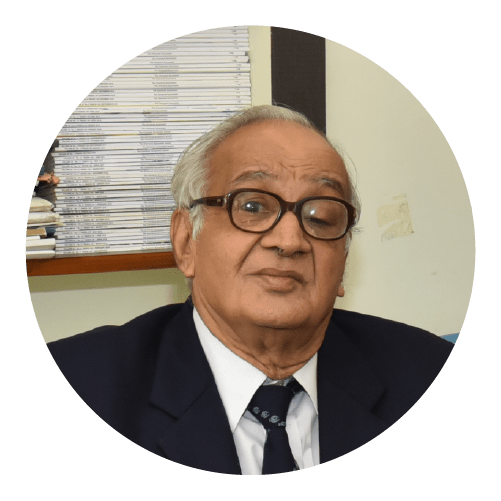

Surendra Kumar Jain

Managing Partner (FCA, B.Com)

Surendra Kumar Jain is an accomplished Chartered Accountant in practice since 1969. A man of few words & more of action. An enabler of growth for the JSCO family.

His expertise extends to:

- Corporate Audit

- Tax Audit

- Trust Audit under The Income Tax

- Income Tax Compliances

- Audit Bureau of Circulation Audits

Through his long standing experience & proficiency, he has effectively exceeded expectations. Previously, a partner in N.C. Dhadda & Co. managing the Audit & Assurance department & Income tax compliances.

He is an active member of Shri Jain Swetambar Sangh Sanstha-Jawahar Nagar.

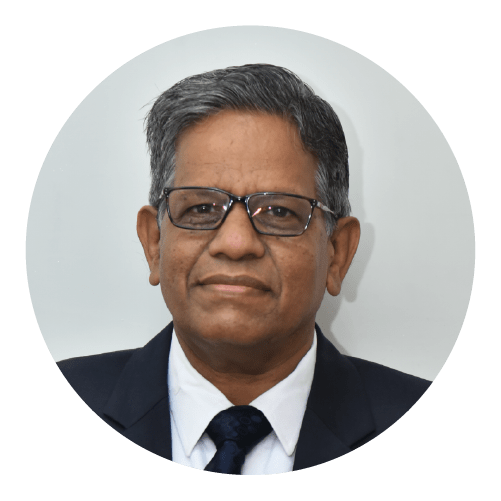

Narendra Shrimal

Managing Partner (FCA, B.Com)

Narendra Shrimal is a qualified Chartered Accountant with invaluable experience of over 40 years. He has been instrumental in laying down the JSCO foundation, in terms of both operations & culture.

His specialty lies in:

- Strategic Financial

- Advisory Direct Tax

- Statutory & Trust Audit

His earlier work experience includes providing corporate advisory, tax planning & handling tax litigation matters as a partner in N.C. Dhadda & Co. His rich experience has driven many organisations & individuals towards persistent growth & stability.

He has been a member of the executive committee of Shri Jain Shwetambar Shrimal Sabha in Jaipur, Honorary Secretary of Shri Veer Balika Sanchalak Mandal for 8 years & treasurer of Mahaveer International for 2 years.

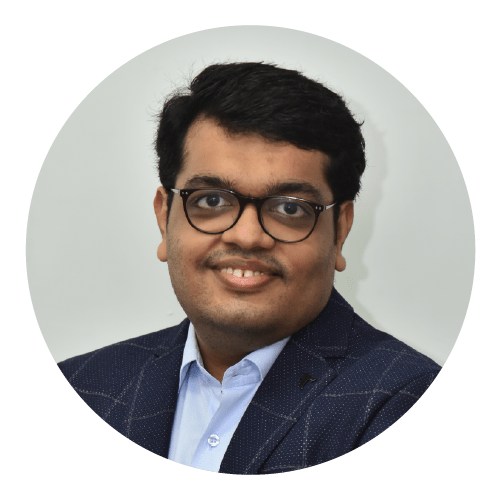

Naman Shrimal

Managing Partner (FCA, B.Com)

Qualified as a Chartered Accountant in 2010, Naman Shrimal is also an Associate Certified Chartered Accountant from Association of Certified Chartered Accountants in the UK, a Certified Corporate Director from the Institute of Directors & an Advance Diploma in International Taxation by CIOT in the UK.

Naman has published & presented several research papers at conferences & publications organised by illustrated organizations both regional & national. Adding to his credentials, he is an honoured member of various organisations which include ICAI, BCAS, JCAG etc.

His areas of specialization include:

- Transfer Pricing

- Inbound & Outbound Investment Strategy

- FEMA Regulations

- Due diligence.

Having made an undying contribution to the industry, Naman Shrimal has also been instrumental in the professional growth & development of aspiring Chartered Accountants.

Our Team

- Statutory Audit as per Income Tax & Companies Law

- Tax Audit as per Income Tax Laws

- Bank Audit

- Corporate Advisory

- Ind-AS & AS Advisory

- Member of the Audit Bureau of Circulation Audits.

Nikesh Sharma

|

Partner - Audit & Assurance (ACA, B.Com)

His specialisations include:

Statutory Audit as per Income Tax & Companies Law Tax Audit as per Income Tax Laws Member of the Audit Bureau of Circulation Audits

- Assessment under Income Tax Laws

- Representation before CIT(A)

- NRI-Tax Planning

- International Taxation

- Income Tax Laws

In his free time, he enjoys reading books & watching sports, specifically cricket & football. A keen analyser of the stock markets, Anuprav has an aggressive hunger for growth and believes in adding value to any ecosystem that he’s part of.

Transfer Pricing

FEMA Laws

RBI Compliance

With an appetite for growth through learning, she is currently pursuing a post qualification Diploma in Internal Taxation conducted by the ICAI. She enjoys writing.

Business Consulting

Internal Audit

Transaction Advisory

We are connected with